What does it all mean?

Many people believe benefits to be synonymous with health insurance offered by an employer, which usually covers medical and sometimes dental and vision. However, the reality of benefits is far more complex than that.

For one, benefits do not always come from an employer, there are actually multiple sources from which they can be provided. Additionally, the benefits themselves cover a wide range of services and needs; although they are often related to health, they can also include many other aspects of a happy, healthy lifestyle.

To complicate matters further, the pricing of benefits is often difficult to understand. Some benefits can be provided by a group sponsor (like an employer) at no cost to the member, some are paid for directly by the member, and other are paid for by both the sponsor and the member.

We’re going to break it down in order to detangle and explain what the different types of benefits really are. While benefits can broadly include things like retirement benefits and PTO, for the scope of this article, we will just explore voluntary benefits.

Voluntary Benefits Explained

There are certain benefits that an employer is legally required to offer to all employees as long as the company is over a certain size (usually 50 full time employees) making them mandatory. It’s important to note that employees are not required to enroll in them, but employers are required to offer them.

Why are they called “voluntary”?

Voluntary benefits are also known as supplemental insurance or employee-paid benefits. These benefits can be things like additional insurance plans like disability or hospital indemnity, products like pet insurance, or services like Identity Protection. A company may choose to offer a variety of voluntary benefits, and the employees may choose to select those benefits as part of their benefits package or they can decline some or all of them. The word voluntary refers to the requirements of the group sponsor, not of the member. The member can elect or decline to enroll in voluntary and non-voluntary benefits.

So, which benefits are voluntary, and which are not?

Mandatory Benefits

Mandates set by federal, state, and local statute can determine which benefits are considered non-voluntary. These mandates have specific rules when it comes to companies of different sizes; part-time or full-time employees or contract labor; and other factors.

Typically, a company with a staff of 50 or more is required to offer their full-time employees unemployment insurance, workers compensation insurance, family and medical leave (FMLA), social security, and paid time off (PTO).

Employers typically pay for a significant portion of these benefits for their employees and another portion is paid by the employees themselves via payroll deduction. Employees cannot opt out of contributing to things such as social security, but they may have options for how unused PTO is paid out or lost at the end of a period.

Benefits that are voluntary

Benefits that are voluntary can include things like vision, and dental insurance; retirement accounts and pensions; life insurance; and lifestyle benefits such as telemedicine, retail discounts, and wellness programs.

Voluntary benefits can also include a wide array of lifestyle perks and programs. This can be anything from additional insurance plans and protection from identity theft to travel and shopping discounts.

These voluntary benefits are often provided by the employer, and the employee who has opted for them pays a portion or up to 100% of the cost through payroll deductions. Even if the employer does not pay a part of the cost, the advantage for the employee is that they are given a reduced group rate compared to what they would pay for the benefit outside of the company, and the company saves on their expense with pre-tax payroll deductions.

Where can you get voluntary benefits?

There are four primary sources from which you might get your benefits.

Employers

The most common source to look for voluntary benefits is through your employer. Generally, every company, large and small, will offer health insurance (when required), dental, and a wellness program of some kind.

Outside of these general coverages, the voluntary benefits offered by any one company can vary greatly.

School

University students are required by the college they attend to have health insurance.

Although young adults can now stay on their parents’ insurance plans until the age of 26, a health insurance plan can be acquired through the university for students that need coverage for one reason or another.

Universities often offer a wide variety of programs on campus for mental health and wellness. These are often similar to that which a thoughtful employer would offer to their employees.

Government

Federal, state, and local governments provide a variety of different benefits to individuals who meet specific criteria.

Age, employment status, legal status, specific conditions, and earnings can contribute eligibility. Well known examples are Medicare, Medicaid, and unemployment insurance but there are many programs that provide reimbursements or credits based on smart choices or other needs.

Groups

Many affinity groups and associations offer benefits to their members. Offering benefits makes membership more attractive and can help maintain membership numbers. These benefits can compliment the overall mission of the group or be totally unrelated. For example, an alumni group might offer discounted identity protection just as an added perk of being a member.

Why don’t all groups offer voluntary benefits?

Despite the many options out there for voluntary benefits, not all groups are able to offer these products, services, and benefits to their employees or members. Many times, the root of this problem is tied to the size of the organization.

Unfortunately, small or even medium sized organizations are often not large enough to get competitive rates for popular plans. Without the time and resources to search for alternatives on their own, the idea of finding a robust voluntary benefits program is thrown out prematurely.

Even when working closely with a broker, a small group won’t always receive the necessary attention and effort required to find a benefits program that will work for them.

Simplify with Breakroom Benefits

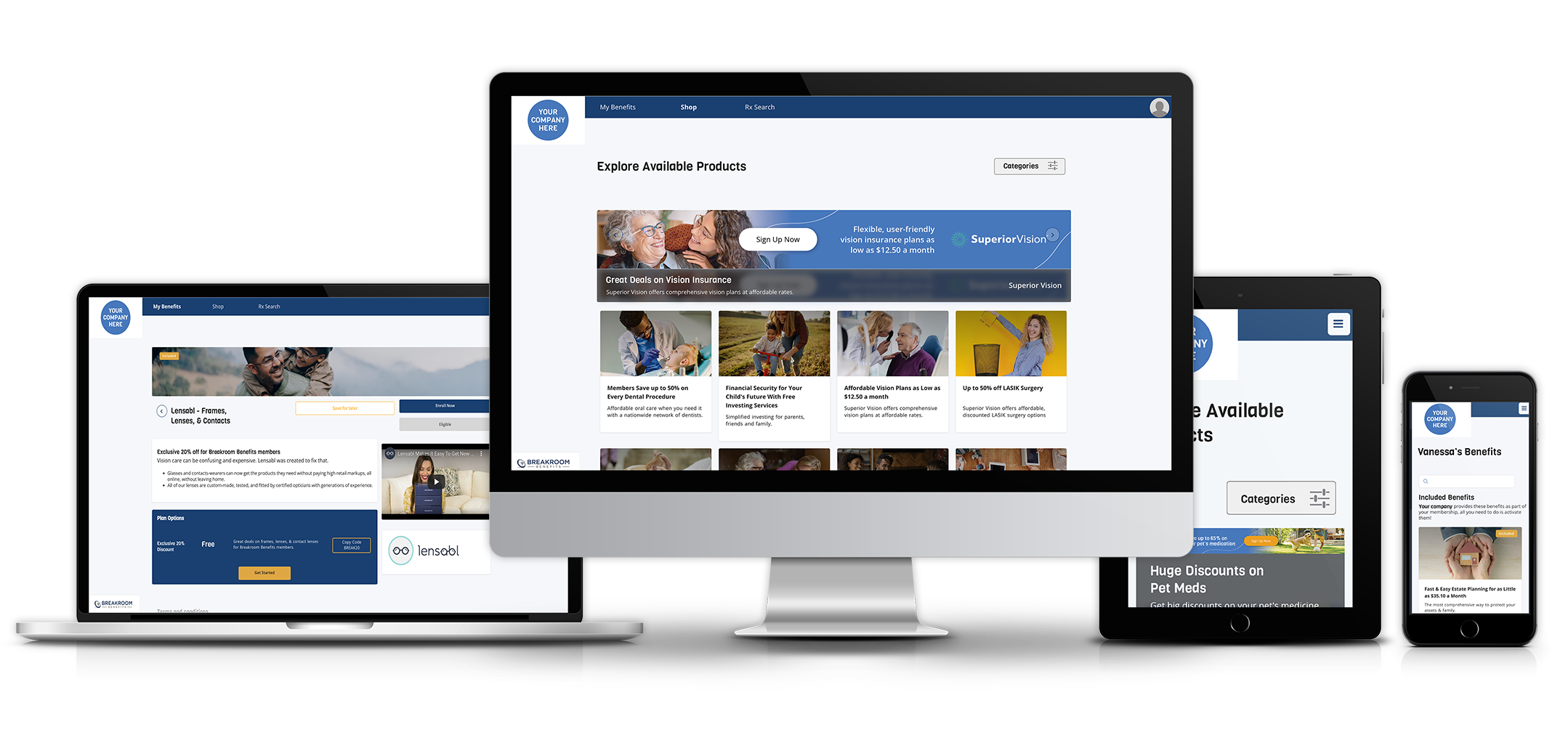

Designed with small to medium sized companies in mind, Breakroom Benefits can help an HR team or an affinity group offer benefits that they need to keep their employees happy.

We want people to get the care and benefits that they need, and we’ve found that the best way to do that is by eliminating the complexity and delivering curated benefits without the hassle.

If your organization is interested in providing access to great benefits, affordably, click below to sign up for 7-day free trial.